Lease Accounting is changing: What UK companies need to know ahead of 2026

22/09/2025

Major changes to lease accounting are on the way for UK businesses applying Financial Reporting Standards (FRS) 102. Following its recent periodic review, the Financial Reporting Council (FRC) has confirmed that most leases will soon need to appear on company balance sheets. This marks a significant step towards alignment with international reporting under IFRS 16. The new rules apply to accounting periods beginning on or after 1 January 2026, with early adoption permitted. For businesses that rely on leased assets, whether property, vehicles, or equipment, this represents a major shift in financial reporting and how key performance measures are presented.

These changes aim to enhance the quality and transparency of financial reporting, while aligning more closely with International Financial Reporting Standards (IFRS).

The amendments fall into three categories:

- Fundamental

- Incremental

- Minor clarifications

Everything you need to know

What’s changing?

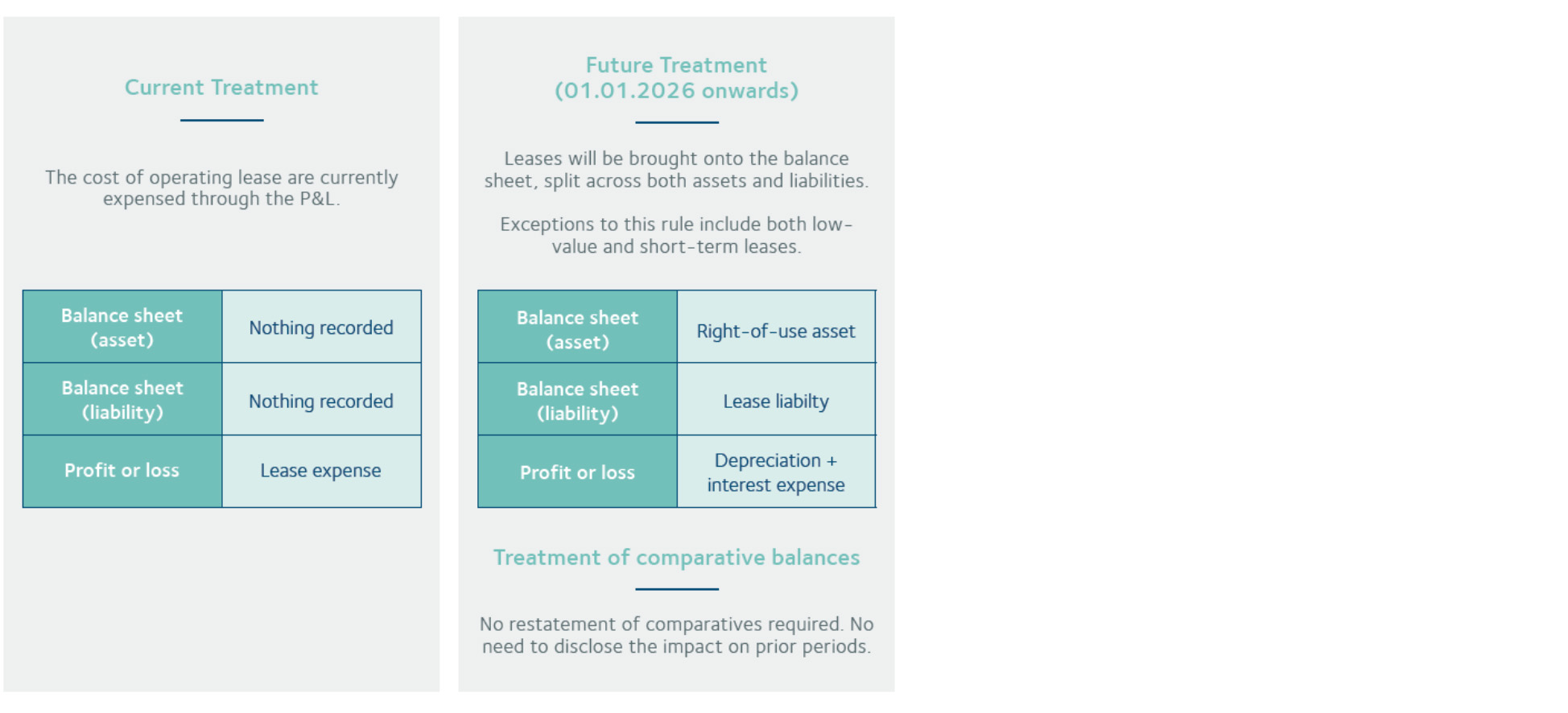

Currently, under FRS 102, leases are split into:

- Finance leases: which are already capitalised and included within the balance sheet

- Operating leases: which are kept off the balance sheet and charged through the profit and loss account as rental expenses.

From 2026, this distinction will disappear for lessees. Instead, almost all lease arrangements will need to be recognised on the balance sheet as:

- A right-of-use asset, and

- A lease liability, measured at the present value of future lease payments.

Why the change?

The FRC’s goal is to bring greater transparency and consistency to financial statements.

Currently, many lease commitments are “off-balance sheet”, meaning they are not always obvious to investors, lenders, or regulators. By requiring recognition of lease assets and liabilities, the revised standard provides a clearer picture of a business’s financial obligations and overall financial health.

Who is affected?

The changes apply to small companies, reporting under FRS 102 1A, or FRS 102 which includes:

- Medium-sized companies

- LLPs

- Charities and not-for-profits in the UK and Ireland

Who is exempt?

The changes do not apply to the following:

- FRS 101 reporters already follow IFRS 16, so no change is required

- FRS 105 (micro-entities) remains unaffected

Leases (for lessees)

The impact it will have

What does this mean for your business?

The revised lease accounting model will have a wide-ranging impact:

- Balance sheet growth: Assets and liabilities will increase as leases are capitalised.

- Profit recognition changes: Rental costs will no longer be a straight-line expense. Instead, leases will be split into depreciation of the asset and interest on the liability, typically leading to higher costs earlier in the lease term.

- Key performance indicators: Measures such as EBITDA, gearing ratios, and loan covenant tests may be significantly affected.

- Disclosure: Businesses will need to provide additional detail about lease terms, assumptions, and maturity schedules in their financial statements.

When and how to prepare

The revised rules take effect from 1 January 2026, but early adoption is an option. Transition reliefs are also available, including a modified retrospective approach that avoids restating prior year comparatives.

To get ready, businesses should now:

- Review all lease contracts and commitments

- Assess systems and accounting processes for capturing lease data

- Model the impact on KPIs and external reporting

- Engage stakeholders early, including accountants, lenders, and board members. What does this mean for your business?

How JW Hinks can help you

At JW Hinks, we are already working with clients to prepare for the revised FRS 102 lease accounting model. Our support includes:

- Assessing the impact on your financial statements

- Reviewing contracts and identifying affected leases

- Advising on system and process changes

- Supporting disclosure requirements and transition choices

The changes may feel complex, but with the right preparation, businesses can adapt smoothly and avoid disruption. Contact JW Hinks today to discuss how these changes may affect your organisation and how we can support you through the transition.